Download FREE Report Sample

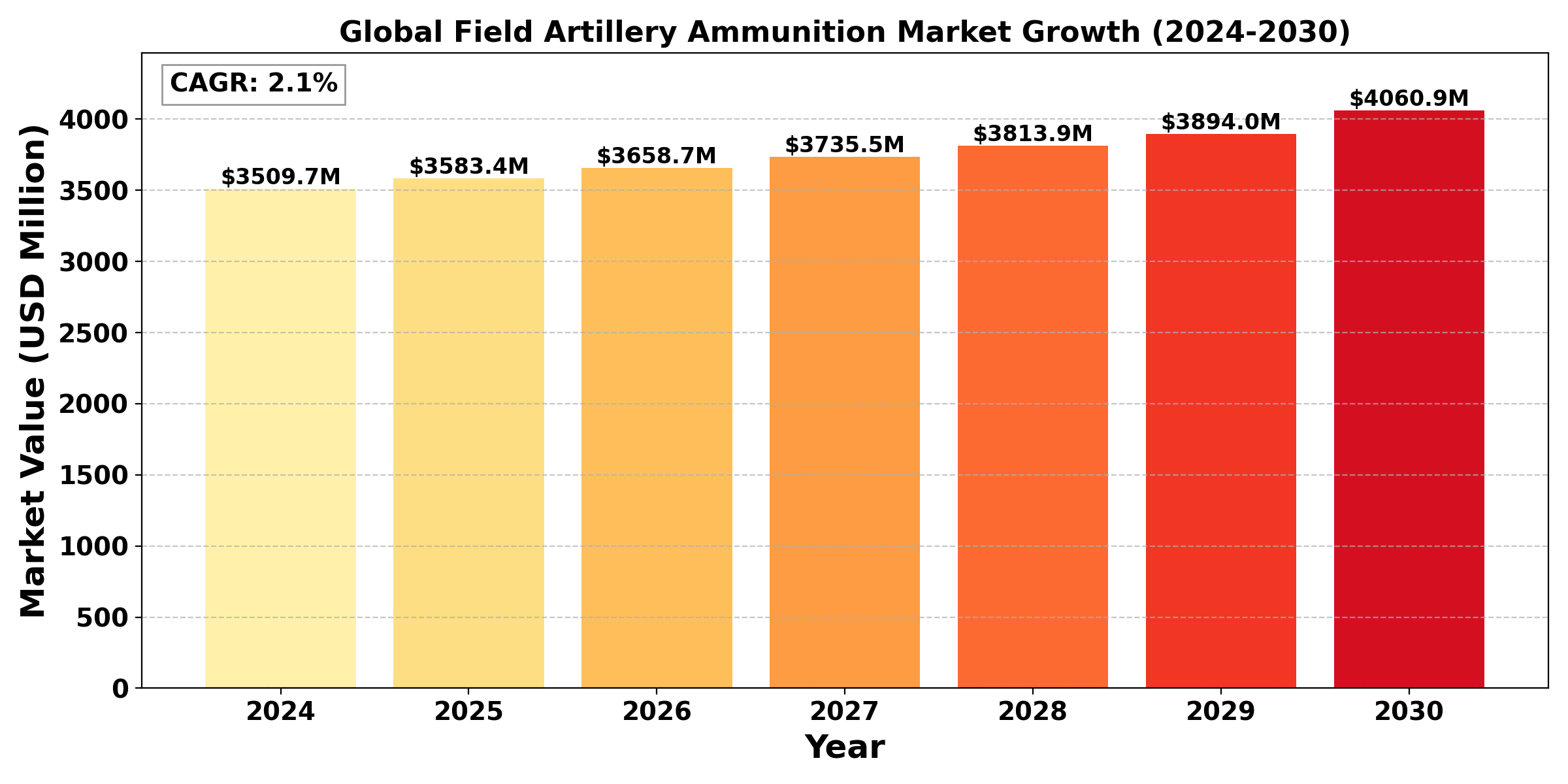

Download Free sampleThe "Global Field Artillery Ammunition Market" was valued at US$ 3509.7 million in 2024 and is projected to reach US$ 4060.9 million by 2030 at a CAGR of 2.1% during the forecast period. The influence of COVID-19 and the Russia-Ukraine War were considered while estimating market sizes.

Ammunition is the material fired, scattered, dropped or detonated from any weapon. Ammunition is both expendable weapons (e.g., bombs, missiles, grenades, land mines) and the component parts of other weapons that create the effect on a target (e.g., bullets and warheads). Nearly all mechanical weapons require some form of ammunition to operateA vital component of the defence and military industries, the global field artillery ammunition industry provides ammunition for a range of artillery systems utilised by armed forces across the globe. In order to support ground forces with fire during combat operations, field artillery ammunition—which includes shells, rockets, and other projectiles—is crucial for long-range bombardment. Geopolitical tensions, continuous military modernisation initiatives, and growing defence budgets in many nations—especially in North America, Europe, and Asia-Pacific—are the main drivers of the demand for artillery ammunition.

The artillery sector is changing as a result of technological advancements including extended-range artillery systems and precision-guided munitions. By lowering collateral damage and improving mission effectiveness, these advancements are drawing increased attention to intelligent and more precise ammunition that can be utilised with sophisticated targeting systems. To increase their operational capabilities, nations are also spending money to upgrade their artillery stocks.

The business does, however, confront obstacles, including as strict laws governing the trade in weapons and the increased focus on lessening the environmental effect of military operations, which is prompting research into more ecologically friendly and sustainable armaments. All things considered, technical advancement and the ongoing requirement for military preparedness worldwide are driving the global field artillery ammunition industry's evolution.

Segmental Overview

120mm Artillery Ammunition to hold the highest market share: By type

To know more about market statistics, Download a FREE Sample copy

In the global field artillery ammunition market, 120mm artillery ammunition holds the highest market share. This is largely due to its widespread use in modern military operations, particularly for mortars and howitzers, which are integral to ground forces. The 120mm calibre offers a balance between range, power, and mobility, making it a versatile choice for both offensive and defensive operations. Many countries' defense forces favor 120mm ammunition for its effectiveness in providing long-range indirect fire support, and it is commonly used in main battle tanks, artillery pieces, and heavy mortars. Its popularity is also driven by the growing emphasis on upgrading artillery systems with more advanced, extended-range, and precision-guided munitions. Furthermore, global military modernization programs and the increasing deployment of 120mm systems in conflict zones reinforce its dominance in the market.

While 60mm and 81mm rounds are still widely used for specific tactical purposes, especially in infantry and mobile units, the 120mm caliber remains the preferred choice for heavy artillery applications, giving it the largest share in the field artillery ammunition market.

High-Explosive (HE) to hold the highest market share: By Application

In terms of application, the Global Field Artillery Ammunition Market has been segmented as High- Explosive (HE), Smoke, Illumination, and Trading Rounds.

High-Explosive (HE) ammunition has the largest market share in the global field artillery ammunition industry. As they can effectively deliver a substantial amount of explosive power against a variety of objectives, including enemy people, vehicles, and fortifications, High-Explosive (HE) rounds are the most widely utilised form of artillery ammunition.

High-Explosive (HE) rounds are a mainstay in military operations, whether in counterinsurgency or conventional warfare situations, due to their adaptability and deadly nature. Their versatility, which includes pinpoint strikes and area bombardment, increases their usefulness in a range of combat scenarios. Ongoing military modernisation initiatives and the requirement for increased firepower in armed forces across the globe are other factors driving the market for HE ammunition.

Rising defence budgets among NATO members and the necessity to improve military preparedness in the face of geopolitical tensions—particularly with regard to Russia's actions in Eastern Europe—have an impact on the European economy. As a result of many European countries improving their artillery capabilities, more ammunition of all kinds is being purchased.

The market for field artillery ammunition is expanding quickly in the Asia-Pacific area due to increased military spending in nations like China, Japan, and India. Due to territorial conflicts and worries about regional security, these countries are expanding their arsenals and modernising their artillery units. Due to the constant need for artillery ammunition brought on by continuing conflict and military operations in these countries, the Middle East and Africa are also developing markets. The global field artillery ammunition market's geographical overview, taken as a whole, shows a landscape characterised by strategic military spending, changing threats, and an emphasis on improving operational capabilities across various regions.

The competitive analysis of the global field artillery ammunition market reveals a landscape dominated by several key players who are heavily involved in the production and supply of various types of ammunition. Major manufacturers include BAE Systems, Northrop Grumman, Thales Group, Elbit Systems, and Rheinmetall AG, among others. These companies leverage advanced technologies and extensive R&D capabilities to develop innovative and effective artillery munitions.

➣ October 1st 2024, In order to continue working together on critical capabilities like the F-35 Lightning II, uncrewed aerial systems, electronic warfare, radar systems, and missile defence, Northrop Grumman Corporation and Terma, the biggest aerospace, defence, and security company in Denmark, have signed a Memorandum of Understanding (MOU). The deal reaffirms Northrop Grumman's long-time dedication to NATO, Denmark, and the safety of the US and its allies.

➣ September 30th, 2024, The U.S. industrial corporation Honeywell and Düsseldorf-based technology group Rheinmetall have signed a memorandum of understanding (MoU) to establish strategic collaboration in a number of technological domains. Among other things, the two businesses plan to work together on innovative visual systems and auxiliary power units for automobiles.

➣ September 20th, 2024, MBDA Deutschland and Rheinmetall have made the decision to carry on their successful partnership in the area of laser weapons. The goal is to launch a collaborative maritime solution in the next five to six years, which creates new opportunities, especially for shipboard drone defence. Both businesses are certain that they can successfully construct a military laser weapon system because of their complimentary laser weapon technology skills.

With a primary focus on military applications, the end-use industry research of the global field artillery ammunition market identifies a number of crucial sectors propelling demand for artillery munitions. The majority of end users are defence forces, and artillery ammunition is essential to ground operations because it supports infantry and armoured formations with fire. Both conventional and asymmetric military operations require a consistent supply of precision-guided bombs, smoke shells, and high-explosive (HE) rounds, all of which improve operational effectiveness and mission success.

The market for field artillery ammunition directly benefits from this budgetary commitment, which promotes the acquisition of cutting-edge military technologies. The United States is the world's largest military power with a defense budget of approximately $730 billion. The Department of Defense is the largest employer in the U.S. with 1.3 million active-duty military personnel and over 800,000 in reserves.

Increasing defense budget allocation across different countries

The increased defence budgets of different countries, which reflect a growing emphasis on modernising military capabilities, are the main factors driving the global market for field artillery ammunition. As geopolitical tensions increase, nations are spending a lot of money modernising their artillery systems, including acquiring cutting-edge ammunition types that improve operational effectiveness, precision, and lethality. Precision-guided munitions, which offer increased accuracy and less collateral damage, and smart technologies are frequently integrated as part of this modernisation drive. A wide variety of artillery ammunition is in greater demand as a result of governments' increased efforts to improve their artillery capabilities due to the growth in hostilities and military engagements in different regions. This trend is expected to continue as nations prioritize national security and defense readiness, resulting in sustained growth in the global field artillery ammunition market.

Furthermore, international collaborations and defense partnerships are facilitating the sharing of technology and expertise in ammunition development. Joint military exercises and training programs are fostering interoperability between allied nations, leading to increased standardization of artillery systems and ammunition. This collaborative approach not only enhances operational readiness but also creates a more robust market for field artillery ammunition as nations seek compatible munitions for joint operations.

Technological Advancement

Military capabilities have undergone significant changes by technological developments in the field artillery ammunition industry, especially with the incorporation of precision-guided munitions (PGMs). To greatly improve precision and efficacy on the battlefield, these high-tech munitions use cutting-edge guidance technologies like GPS, inertial navigation, or laser guidance. Because PGMs are designed to modify their flight paths in real time, they can precisely engage designated targets while reducing the potential of collateral damage, in contrast to traditional artillery shells, which depend on ballistic trajectories that might cause significant target deviation. In contemporary combat, where operational settings are frequently complex and highly populated, this capacity is especially crucial because it demands a higher level of precision to preserve infrastructure and civilians.

Additionally, adaptive targeting made possible by the development of smart munitions with sophisticated sensors enables artillery units to react quickly to changes in the battlefield. In addition to making artillery weapons more lethal, this technological advancement gives military leaders better situational awareness, which helps them make well-informed decisions and prepare strategically. Because of this, the increasing employment of PGMs is changing military tactics and operational doctrines, resulting in the more efficient and responsible application of artillery in a variety of combat situations.

Strengthen Regulations compliances and export control

For manufacturers in the around the globe field artillery ammunition market, export restrictions and regulatory compliance provide serious obstacles, resulting in a complicated environment that affects market access and operational effectiveness. Strict national and international laws, such as the Arms Trade Treaty (ATT) and different export control regimes that vary from nation to nation, govern the manufacture, distribution, and sale of military ammunition. It can be difficult to navigate these rules, and manufacturers must devote a lot of effort to comprehending and following compliance requirements, which might differ greatly between jurisdictions. Especially for smaller enterprises and those aiming to reach emerging markets where regulatory frameworks may be less developed, this complexity frequently results in higher administrative expenses and legal difficulties.

Furthermore, the possibility of sanctions and penalties for non-compliance can discourage investment and innovation by fostering a risk-averse environment. The procurement process may be slowed down by the requirement for copious documentation, audits, and reporting, which would further impair a manufacturer's capacity to effectively compete. As a result, these regulations may restrict some businesses' access to markets, so inhibiting industry competitiveness and innovation and strengthening the position of larger, more established firms that have the financial means to overcome these obstacles. Consequently, manufacturers' strategic choices are greatly influenced by the regulatory environment, which also affects their market positioning and capacity to adjust to changing military requirements and global demand.

The report includes Global market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis Type, Application, The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes |

Details |

|

Segments |

By Type:

By Application:

|

|

Region Covered |

|

|

Key Market Players |

|

|

Report Coverage |

|

Speak to our Custom Research Team and get the Custom Research in a budget

Custom ResearchFrequently Asked Questions ?

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Upto Working 24 to 48 hrs

Upto 72 hrs max - Weekends and Public Holidays

Online Payments with PayPal and CCavenue

Wire Transfer/Bank Transfer

Hard Copy

Industry Market Size

Industry Market Size SWOT Analysis

SWOT Analysis Industry Major Players

Industry Major Players Revenue Forecasts

Revenue Forecasts Historical and Forecast Growth

Historical and Forecast Growth Profitability Analysis

Profitability Analysis