COMPANIES COVERED

Sichuan Nitrocell CorporationDownload FREE Report Sample

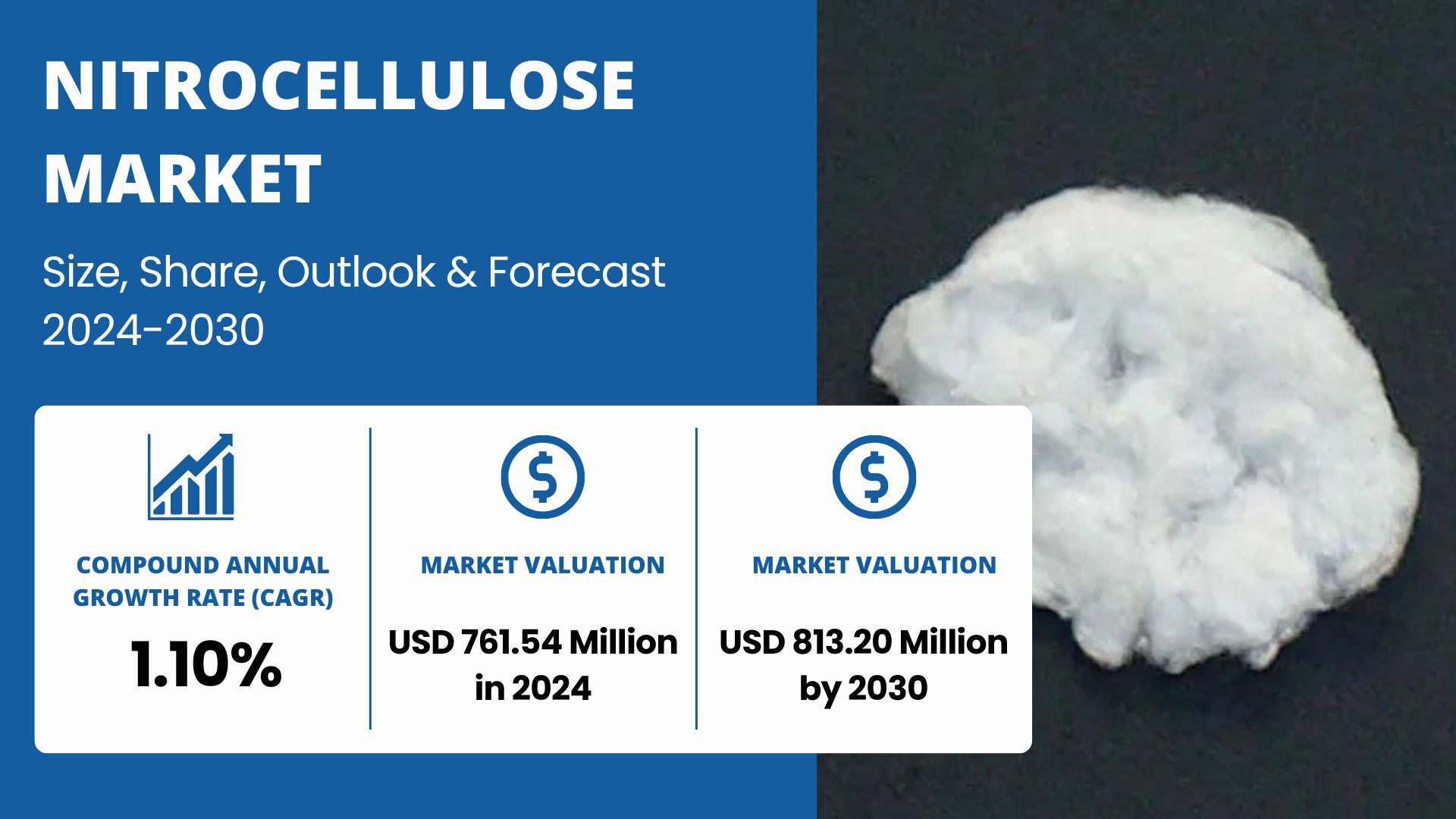

Download Free sampleThe "Global Nitrocellulose Market" Size was estimated at USD 761.54 Million in 2024 and is projected to reach USD 813.20 Million by 2030, exhibiting a CAGR of 1.10% during the forecast period.

Nitrocellulose is a highly flammable compound formed by nitrating cellulose through exposure to nitric acid or another powerful nitrating agent. When used as a propellant or low-order explosive, it was originally known as guncotton. If the cellulose is not fully nitrated then it has found uses as a plastic film and in inks and wood coatings.

The market for nitrocellulose is propelled by its extensive use in a variety of sectors, including consumer goods, automotive, paints & coatings, and inks. Particularly utilised in wood lacquers, printing inks, and nail polishes, nitrocellulose is renowned for its quick drying time, strong adhesive strength, and flexibility. The market is expanding due to the rising demand for high-performance coatings in the furniture and automotive industries, as well as the increased use of nitrocellulose in propellants and explosives. However, because of its volatility and flammability, it presents difficulties when it comes to handling and manufacture because of strict environmental requirements. Future market dynamics may be impacted by growing interest in eco-friendly and biodegradable substitutes..

In terms of type, the Global Nitrocellulose industry has been segmented as E-grade Nitrocellulose, M-grade Nitrocellulose, A-grade Nitrocellulose, and Others

M-grade nitrocellulose usually has the largest market share in the nitrocellulose industry. M-grade nitrocellulose finds extensive application in important end-use sectors such as printing inks, paints, varnishes, and coatings. It is especially well-liked in industries like automotive, furniture, and packaging because of its moderate nitrogen concentration, which provides the perfect conditions for creating premium, quick-drying lacquers and finishes.

While A-grade nitrocellulose, which has a lower nitrogen percentage, is only seldom employed in specific industrial applications, E-grade nitrocellulose, which has a higher nitrogen level, is more frequently utilised in explosives, propellants, and other military uses. Despite having their own markets, E-grade and A-grade typically occupy smaller portions than M-grade, which is driven by higher demand from the ink and coatings industries.

To know more about market statistics, Download a FREE Sample copy

Coating and Paint to hold the highest market share: By Application

In terms of Application, the Global Nitrocellulose industry has been segmented as Coatings and Paints, Printing Inks, Celluloid, Others.

The coatings and paints sector has the most application share in the nitrocellulose market. Nitrocellulose's fast-drying qualities, superior adhesion, and durability make it a popular ingredient in high-performance coatings and paints, particularly in the furniture, automotive, and wood finishing sectors. Coatings made of nitrocellulose give objects a smooth, glossy sheen that improves their visual appeal. This makes them perfect for applications that call for high-end finishes, like wood varnishes, guitar lacquers, and car clear coats. Additionally, the expanding furniture, automobile, and construction sectors—particularly in emerging economies where industrialisation and consumer spending are rising—are driving the demand for nitrocellulose in coatings and paints.

A sizeable amount of the market is also accounted for by the printing inks segment, especially in the flexible packaging and labelling industries. Its market share is lower than that of paints and coatings, nevertheless. Celluloid and other specialised uses, including propellants and adhesives, are found in niche markets where demand is comparatively low. Nitrocellulose is widely used in paints and coatings, especially for ornamental and industrial applications, which guarantees that this application will continue to dominate the market as a whole.

With a consistent need for nitrocellulose, particularly in printing inks, defence applications, and premium wood coatings, North America and Europe come next. However, there are difficulties because of the strict environmental laws in these areas, especially with regard to volatile organic compounds (VOCs) and the handling of hazardous materials. Nevertheless, European bio-based nitrocellulose innovation and technological breakthroughs may open up new possibilities.

While the Middle East and Africa are developing economies with rising demand in industrial and construction applications, Latin America is experiencing moderate growth driven by needs for automobiles and construction. The need for printing inks and coatings based on nitrocellulose is anticipated to increase as urbanisation increases in these areas. Nevertheless, in contrast to more developed areas, these markets are still in their infancy.

7 December 2023: DuPont announced that Coryor Surface Treatment Company Ltd. and Nippon Paint Taiwan have introduced a series of new offerings including printed Tedlar PVF solutions and PVF coating in Taipei Building Show, the largest building materials exhibition in Taiwan.

April 6th, 2022, Nitrocellulose Group Announces further worldwide Prices increase on all Industrial Nitrocellulose Grades

With the paints and coatings industry being the largest consumer. Nitrocellulose is highly valued in this sector for producing fast-drying, durable, and glossy coatings, particularly in automotive finishes, wood lacquers, and decorative paints. The growth in construction, furniture, and automotive industries, especially in emerging markets like Asia-Pacific, is driving demand for nitrocellulose-based coatings.

According to Global Construction 2030, three nations—China, the United States, and India—will lead the way and account for 57% of all global growth in the construction industry, which is expected to rise by 85% to $15.5 trillion globally by 2030.

The Global paint and Coating market was valued at US$ 213.77 million in the year 2023, and is expected to experience a robust growth of US$ 278.38 million by the year 2029 and is anticipated to grow at a CAGR of 4.50% during the forecasted period. The U.S exported over $2.5 billion in coating product, while generating a substantial trade surplus of $1.4 billion.

Increasing demand for high-performance coatings in the automotive and construction industries.

The increasing need for high-performance coatings in the construction and automotive sectors is a major factor propelling the nitrocellulose market. Nitrocellulose-based coatings are highly valued in the automobile industry due to their quick drying times, resilience, and capacity to produce high-gloss finishes—all of which are critical for surface protection and aesthetic appeal. The need for these coatings keeps growing as more cars are produced worldwide, especially in developing nations like China and India.

Nitrocellulose is utilised in wood coatings and varnishes for flooring, furniture, and other architectural components in the construction industry because of its quick-drying and long-lasting finish, which makes it perfect for both protective and decorative applications. The demand for high-quality coatings is further fuelled by the growth of the construction industry, which is fuelled by growing urbanisation, infrastructure development, and increased housing demand. The need for nitrocellulose in coatings is anticipated to increase as both industries look for high-end finishes that improve product lifetime and aesthetic appeal, propelling market growth.

The stringent safety and environmental laws controlling the manufacture, handling, and use of nitrocellulose provide a serious barrier to the market. Because nitrocellulose is extremely dangerous and flammable, it must be manufactured, stored, and transported with extreme caution. Manufacturers' operating costs are increased by complying with these rules, particularly in areas with stricter safety and environmental standards like North America and Europe.

Furthermore, governments are being pressured to enact more stringent environmental regulations due to worries about the emissions of volatile organic compounds (VOCs) linked to nitrocellulose-based products, like paints and coatings. This has limited the growing potential of nitrocellulose in many applications by increasing regulatory pressure on industry to adopt safer, low-VOC, or water-based substitutes. In addition to affecting production costs, these legislative obstacles also make it difficult for new competitors to enter the market, which might impede market expansion and accelerate the transition to greener alternatives.

The increasing popularity of sustainable and bio-based nitrocellulose products is a noteworthy development in the nitrocellulose market. Manufacturers are concentrating on creating environmentally friendly substitutes as environmental concerns and laws pertaining to volatile organic compounds and VOC emissions grow more strict. As a result, more money is being spent on research and development to produce bio-based nitrocellulose from renewable resources, which will have less of an adverse effect on the environment while yet retaining the high-performance qualities required for coatings, inks, and other uses.

In regions like Europe and North America, where businesses are under pressure to lower their carbon footprint and adhere to regulations, there is a particularly high demand for sustainable solutions. End consumers in industries like consumer goods, packaging, and automobiles are also being impacted by this trend, as the use of green products is turning into a crucial differentiation in the marketplace. Additionally, bio-based nitrocellulose is becoming more popular in applications like wood coatings and nail polishes as customer preferences shift towards environmentally friendly products. It is anticipated that this sustainability trend would influence the nitrocellulose market's future course by spurring innovation and creating new avenues for expansion.

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Types, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes |

Details |

|

Segments |

By Type

By Application

|

|

Region Covered |

|

|

Key Market Players |

|

|

Report Coverage |

|

Speak to our Custom Research Team and get the Custom Research in a budget

Custom ResearchFrequently Asked Questions ?

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Upto Working 24 to 48 hrs

Upto 72 hrs max - Weekends and Public Holidays

Online Payments with PayPal and CCavenue

Wire Transfer/Bank Transfer

Hard Copy

Industry Market Size

Industry Market Size SWOT Analysis

SWOT Analysis Industry Major Players

Industry Major Players Revenue Forecasts

Revenue Forecasts Historical and Forecast Growth

Historical and Forecast Growth Profitability Analysis

Profitability Analysis