COMPANIES COVERED

BASFDownload FREE Report Sample

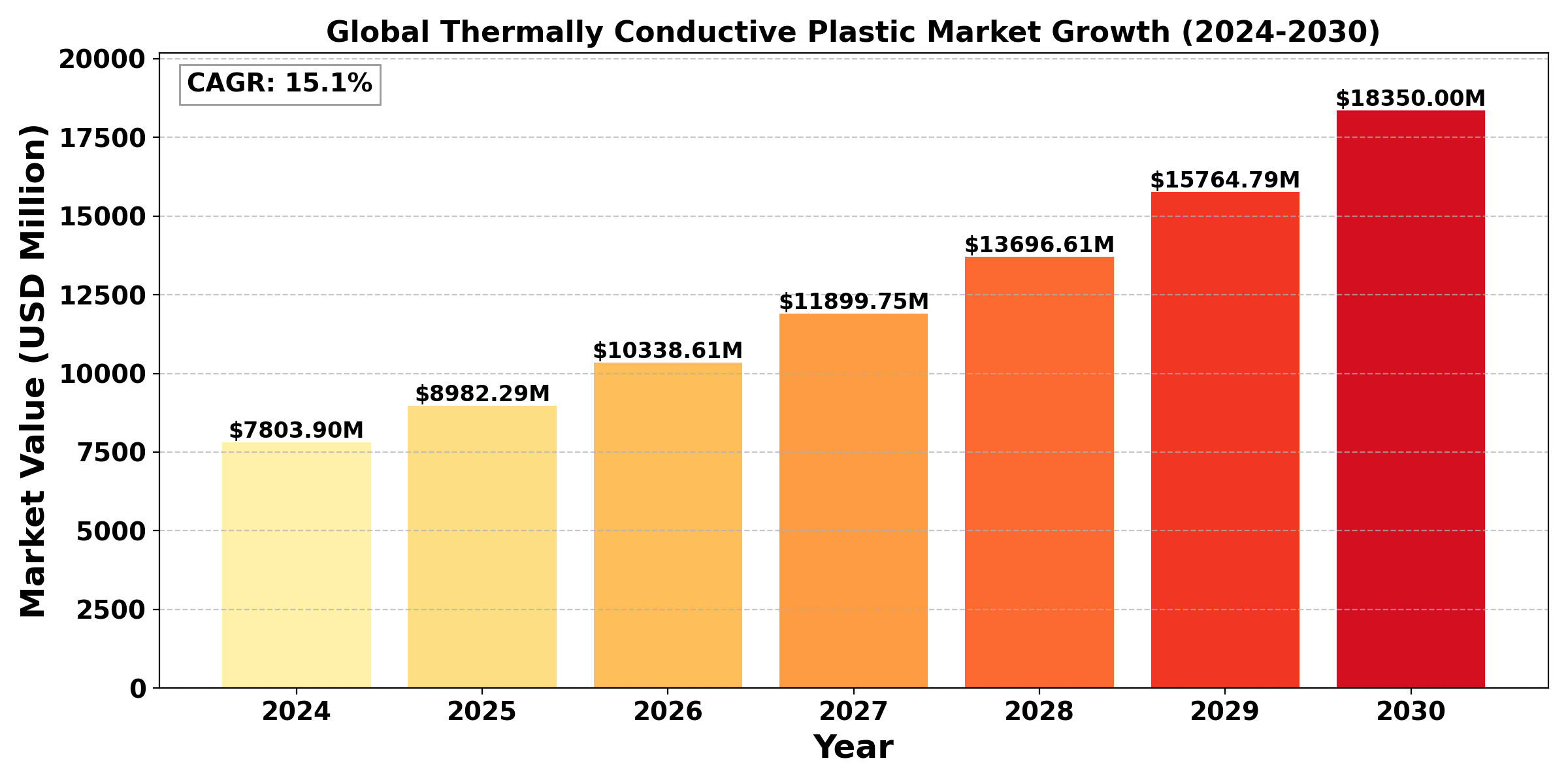

Download Free sampleThe "Global Thermally Conductive Plastic Market" was valued at US$ 7803.9 Million in 2024 and is projected to reach US$ 18350 Million by 2030, at a CAGR of 15.1% during the forecast period.

The market for thermally conductive plastics is growing quickly as businesses look for eco-friendly, multipurpose materials that efficiently release heat. Engineered polymers that contain fillers give thermally conductive plastics their ability to transport heat effectively, which makes them perfect for uses involving conventional metals like electronics, automobiles, LED lights, and consumer goods. The need for materials that can control heat without adding bulk has grown as electronic devices have become smaller, making thermally conductive plastics a desirable substitute for metals like copper or aluminium.

These plastics have several advantages over metals, such as reduced weight, corrosion resistance, and design flexibility. These benefits are especially advantageous for the electronics and automotive industries, where long-lasting and lightweight materials are crucial for enhancing energy efficiency and device longevity. Furthermore, thermally conductive plastics are less expensive to produce on a wide scale due to their ease of manufacturing. Applications needing very high thermal dissipation are limited by the difficulties still present, especially in reaching the same conductivity levels as metals.

Segmental Analysis

Polyamide (PA) holds the highest market share: By Type

Among thermally conductive plastics, nylon, also referred to as polyamide (PA), has the largest market share. Because of its well-balanced strength, flexibility, and thermal conductivity, PA is used extensively in a variety of sectors. It is particularly well-liked for heat-sensitive applications such as electrical connectors, electronics housings, and automotive components. Its endurance and comparatively high melting point make it more appropriate for settings where parts are exposed to heat for extended periods of time.

The versatility of PA, which can be built with different fillers like graphite and ceramic to meet specific conductivity needs, is a major factor in its domination. Because of its adaptability, PA may be tailored by manufacturers to meet various thermal management requirements without sacrificing structural integrity. Furthermore, PA's market share is increased by its cost-effectiveness for high-volume production due to its simplicity of processing and compatibility with injection molding. Among the biggest users of thermally conductive PA are the electronics and automotive sectors, particularly as the need for lightweight, heat-dissipating materials to replace metals in small, energy-efficient designs increases. PA's numerous uses and track record of success in thermal management are therefore expected to keep it at the top of the thermally conductive plastics industry.

Electrical &Electronic Segment to hold the highest market share: By Application

In the market for thermally conductive plastics, the Electrical & Electronics segment has the biggest share. Because of the growing complexity and compactness of electronic equipment, which need efficient heat dissipation to preserve performance and avoid overheating, this industry gains the most from thermally conductive plastics. When compared to conventional metal components, thermally conductive plastics help control heat while lowering weight in parts including circuit boards, LED housings, battery casings, heat sinks, and connectors.

The need for thermally conductive plastics in electrical and electronics applications has increased due to the growth of consumer electronics, smart devices, and electric cars. Manufacturers are replacing metal components with thermally conductive plastics, which have the added benefits of design flexibility, cost effectiveness, and simpler processing, as a result of the trend toward smaller, lighter, and more energy-efficient electronics. The requirement for novel materials that offer both thermal management and structural integrity is anticipated to maintain the Electrical & Electronics segment's dominance in the market for thermally conductive polymers as businesses continue to develop sophisticated electronic gadgets.

Regional Overview

The need for thermally conductive plastics in electrical and electronics applications has increased due to the growth of consumer electronics, smart devices, and electric cars. Manufacturers are replacing metal components with thermally conductive plastics, which have the added benefits of design flexibility, cost effectiveness, and simpler processing, as a result of the trend toward smaller, lighter, and more energy-efficient electronics. The requirement for novel materials that offer both thermal management and structural integrity is anticipated to maintain the Electrical & Electronics segment's dominance in the market for thermally conductive polymers as businesses continue to develop sophisticated electronic gadgets.

Asia-Pacific is the fastest-growing region, with countries like China, Japan, and South Korea playing central roles due to their large electronics manufacturing bases. China’s booming EV market and rapid industrial growth are key factors, along with rising investments in infrastructure, consumer electronics, and LED technology. Japan and South Korea contribute through advancements in electronics and automotive components that prioritize thermal management for enhanced performance.

Competitive Analysis

Recent Development

January 2024, The well-known Japanese materials firm Toray Industries created a new ultra-high molecular weight polyethylene (UHMWPE) plastic sheet that is just as strong and adaptable as steel. The film, which is only 0.1 millimeters thick, has a wide range of inventive uses in consumer goods, automotive components, and flexible electronics. Thermal conductivity of the film is 18 watts per meter-kelvin.

September, 2022, X2F announced that it has joined a unique collaboration with Covestro to develop a thermally conductive automotive heat-sink with in-mold electronics using X2F’s transformative controlled viscosity molding technology.

End Use Industry Analysis

The electronics, automotive, industrial, and healthcare sectors are the top end-use industries served by the thermally conductive plastics market. Thermally conductive plastics are essential in electronics for controlling heat in small devices, such as circuit boards, battery packs, and LED housings. The demand for materials that effectively disperse heat while lowering device weight has increased due to the trend toward compact, high-performance electronics. The need for thermally conductive plastics in components such as battery housings, heat exchangers, and motor parts has increased in the automotive industry due to the drive for lightweight materials to increase fuel efficiency and promote electric vehicle (EV) design.

These materials are especially advantageous for industrial applications, where they improve heat management in machinery and equipment that needs to function dependably in harsh environments. Thermally conductive plastics are used in the healthcare sector in equipment that needs constant temperature control, like imaging systems and diagnostic tools, where careful heat control guarantees accurate operation and patient safety. In general, the need for materials that are lightweight, strong, and thermally efficient—all of which are essential for design, energy efficiency, and sustainability innovations—underpins the demands of every industry. This wide range of applications highlights the adaptability of thermally conductive plastics and their contribution to improving performance in contemporary industrial and technological domains.

Industry Dynamics

Industry Drivers

Increasing Need for lightweight materials

The growing need for lightweight materials in the electronics and automotive industries is one of the main factors propelling the thermally conductive polymers market. Manufacturers are actively looking for materials that reduce weight while preserving thermal performance as the automobile industry moves toward electric vehicles (EVs) and seeks to increase fuel efficiency in conventional vehicles. For applications like battery housings, heat sinks, and motor components, thermally conductive polymers are becoming the material of choice, displacing heavier metals like copper and aluminium. By improving heat management in high-performance EV batteries, guaranteeing durability, and prolonging battery life, these plastics not only help vehicles become lighter but also improve safety.

The requirement for effective heat management without adding bulk has been highlighted in the electronics sector by the drive toward miniaturization and higher power density in gadgets like laptops, cell phones, and LED systems. The perfect answer is offered by thermally conductive plastics, which enable producers to make lightweight, compact designs that can withstand higher heat loads. These polymers' ease of processing, resistance to corrosion, and design flexibility further increase demand for them by empowering producers in a variety of industries to satisfy consumer and regulatory demands for high-performance, sustainable, and energy-efficient goods.

Industry Trend

In the field of thermally conductive plastics, sophisticated, highly tailored compounds that provide enhanced heat conductivity without sacrificing mechanical qualities are becoming increasingly popular. Manufacturers are looking at new filler materials including graphite, carbon fibers, and ceramic particles to improve the thermal performance of plastics as industries demand more heat dissipation. These developments enhance the use of thermally conductive plastics in high-demand applications such as LED lighting, consumer electronics, and electric vehicle (EV) batteries by enabling them to achieve conductivity levels that are closer to those of metals.

The drive for recyclable, sustainable, thermally conductive plastics is another significant development, as laws and environmental concerns push for more environmentally friendly production methods. In order to meet industry demands for thermal efficiency and link their goods with the objectives of the circular economy, businesses are increasingly investigating bio-based polymers and recycled materials. In areas like Europe with strict sustainability laws, where eco-friendly products are more competitive, this tendency is particularly pertinent.

Furthermore, the automotive and electronics industries are focusing more on lightweight and miniaturization, which makes thermally conductive plastics a desirable substitute for metals. In order to balance performance, durability, and environmental responsibility across applications, thermally conductive plastics are becoming increasingly important as wearable technology and electric mobility gain traction.

Industry Restraint

Higher cost of thermally conductive plastics

The comparatively high cost of thermally conductive polymers in comparison to more conventional materials like metals is a major barrier to the global market for thermally conductive plastics. The initial investment for producing and processing thermally conductive plastics can be higher because of the cost of specialized fillers and sophisticated compounding techniques needed to achieve desired thermal properties, even though these plastics have benefits like lightweight qualities and design flexibility.

Their adoption may be restricted by this cost barrier, especially in applications or sectors where cost-effectiveness is crucial. For example, businesses may be reluctant to adopt thermally conductive plastics if the financial benefits do not justify the higher material costs in industries with narrow profit margins, such consumer electronics or car manufacturing. Because of this, the market for thermally conductive plastics may grow more slowly, particularly in areas or market niches where price rivalry and budgetary restrictions are common. It will take constant innovation to lower production costs and raise the thermally conductive plastics' cost-performance ratio in order to overcome this obstacle.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Type, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

Attributes |

Details |

Segments |

By Type

By Application

|

Region Covered |

|

Key Market Players |

|

Report Coverage |

|

Speak to our Custom Research Team and get the Custom Research in a budget

Custom ResearchFrequently Asked Questions ?

A license granted to one user. Rules or conditions might be applied for e.g. the use of electric files (PDFs) or printings, depending on product.

A license granted to multiple users.

A license granted to a single business site/establishment.

A license granted to all employees within organisation access to the product.

Upto Working 24 to 48 hrs

Upto 72 hrs max - Weekends and Public Holidays

Online Payments with PayPal and CCavenue

Wire Transfer/Bank Transfer

Hard Copy

Industry Market Size

Industry Market Size SWOT Analysis

SWOT Analysis Industry Major Players

Industry Major Players Revenue Forecasts

Revenue Forecasts Historical and Forecast Growth

Historical and Forecast Growth Profitability Analysis

Profitability Analysis