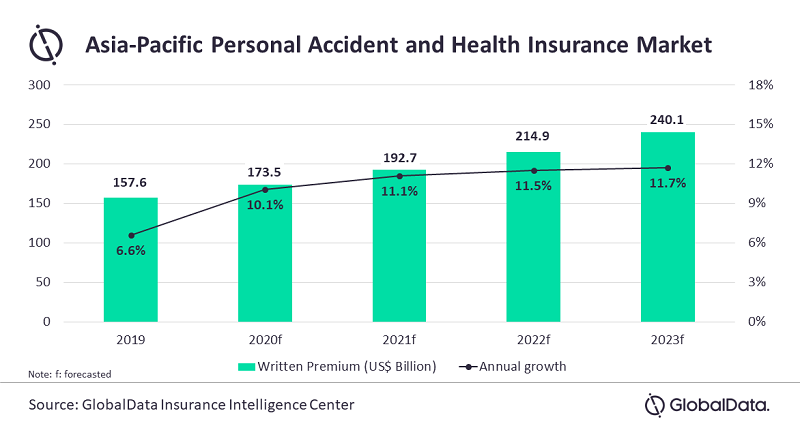

Personal accident and health (PA&H) insurance written premium in the Asia-Pacific region is forecasted to grow from US$157.6bn in 2019 to US$240.1bn in 2023

‘Global Personal Accident and Health Insurance Market to 2023’, reveals that PA&H insurance in Asia-Pacific is projected to grow at a compound annual growth rate (CAGR) of 11.1% during 2019–2023, backed by an expanding middle-class population with growing disposable income.

Manisha Varma, Insurance Analyst at GlobalData, comments: “The disparity in the healthcare delivery standards between developed and emerging markets of the region has accelerated the demand for private insurance during the last five years, with the industry recording a CAGR of 15.5%. Improved standard of living, medical inflation, expanding private health care and the entry of foreign insurers are some factors contributing to the growth.”

The COVID-19 pandemic further highlighted the need for health insurance, particularly in emerging markets, as public healthcare institutions struggled with surge in demand, compelling individuals to seek private insurance for faster treatment. In India, the pandemic led awareness and introduction of new products helped retail health insurance register 43% year-on-year (YoY) growth as of June 2020.

Ms Varma continues: “During the last five years, digitalization and launch of disease specific insurance products helped insurers expand value proposition. In 2018, Chinese insurer Ping An Life launched critical illness insurance product Fu Man Fen, targeting adults and high-end customers. With the outbreak of pandemic, insurers in India were directed by the regulator to provide COVID-19 specific standard policies – Corona Kavach, a mandatory indemnity-based plan; and Corona Rakshak, an optional single-premium plan offering lump-sum benefit.”

Key digitalization initiatives in the region include the use of wearable gadgets in underwriting process and app-based medical consultation service. The wearable devices give insurers access to detailed biometric and activity data from policyholders, allowing insurers to improve underwriting accuracy, prevent claims and increase customer engagement.

The pandemic has provided a further impetus to the use of online consultation as social distancing limited physical visits to the healthcare centers, emerging as an increasingly integral feature in health policies. In January 2020, the number of new users on the Chinese digital health consultation platform Ping An Good Doctor increased by nearly 900%. Singapore-based telemedicine platform MyDoc witnessed a 60% rise in active users in February.

Ms Varma concludes: “PA&H insurance is expected to see major developments as short-term accident covers, critical illness, disease-specific products become more mainstream. Furthermore, technology savvy middle class emerging markets and aging population in mature markets will support the business growth over the next few years.”