Automotive Idling Prevention Systems Market Trends and Forecast 2024

- December 17, 2024

- 14

- Automotive and Transportation

As the automotive industry transitions toward sustainability and energy efficiency, the adoption of idling prevention systems is accelerating globally. These systems, designed to reduce engine idling time, play a pivotal role in lowering fuel consumption, curbing greenhouse gas emissions, and improving overall vehicle performance. With the rise in stringent environmental regulations, combined with increasing fuel costs, the demand for automotive idling prevention systems is set to experience significant growth.

This blog delves deep into the Automotive Idling Prevention Systems Market, highlighting its growth drivers, current trends, real-world examples, and reliable market statistics.

What Are Automotive Idling Prevention Systems?

An idling prevention system stops the engine of a vehicle when it is stationary for a prolonged period, automatically restarting it when the driver engages the accelerator or clutch. These systems are often referred to as stop-start systems or idle-stop systems and are widely integrated into modern vehicles, including cars, trucks, and public transport vehicles.

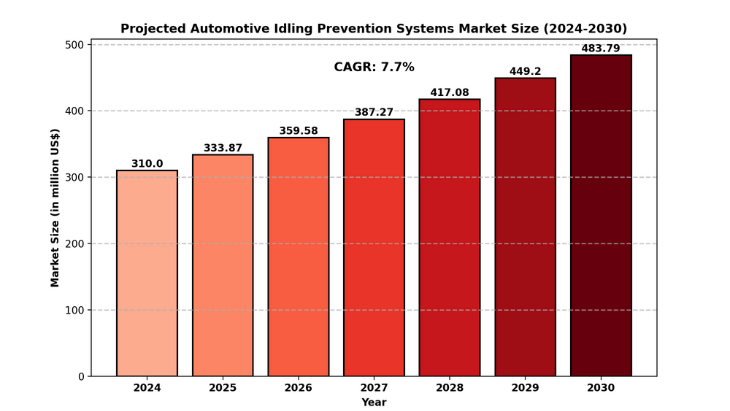

The global Automotive Idling Prevention Systems Market was valued at US$ 310 million in 2024 and is projected to reach US$ 483 million by 2030, at a CAGR of 7.7% during the forecast period.

Market Drivers: Why Are Idling Prevention Systems in Demand?

Rising Environmental Concerns

-

Idle emissions contribute significantly to air pollution, including the release of CO2, NOx, and particulate matter.

-

Governments worldwide are imposing stricter emission standards to mitigate climate change.

-

According to the International Energy Agency (IEA), road transport accounts for nearly 24% of global CO2 emissions, with idling being a significant contributor.

Fuel Cost Savings

-

Vehicles consume up to 1 liter of fuel per hour while idling, depending on engine size and conditions.

-

Idling prevention systems reduce unnecessary fuel consumption, resulting in cost savings for fleet owners and consumers.

-

A report by U.S. Department of Energy (DOE) estimates that idling accounts for 6 billion gallons of fuel wasted annually in the United States alone.

Urban Traffic and Congestion

-

With urbanization and increasing vehicular density, traffic congestion leads to excessive idling. Idling prevention systems address this by improving fuel efficiency during stop-and-go driving conditions.

-

Studies indicate that urban traffic congestion can increase fuel consumption by 20-30% due to frequent idling and acceleration.

Technological Advancements

-

The integration of smart sensors, advanced engine control units (ECUs), and micro-hybrid systems has made these systems more efficient and reliable.

-

Start-stop systems are now standard in over 70% of new vehicles sold in Europe, showcasing widespread adoption.

Market Statistics and Outlook

According to a recent market report:

-

The Global Automotive Idling Prevention Systems Market is projected to grow at a CAGR of 7.7% between 2024 and 2030.

-

By 2024, the market value is expected to surpass $ 310 million, driven by increased adoption in passenger cars and commercial vehicles.

-

North America and Europe remain dominant markets, driven by emission regulations and consumer demand for fuel-efficient vehicles.

For example:

-

In the European Union, regulations such as Euro 6 mandate lower vehicle emissions, pushing automakers to adopt idling prevention technologies.

-

In the United States, anti-idling laws in states like California and New York penalize excessive idling, further promoting the use of these systems.

-

In China, stricter emission standards, such as China VI, are propelling demand for stop-start systems.

Download Free Sample Copy >>> "Automotive Idling Prevention Systems Market"

Real-World Applications and Examples

Ford’s Auto Start-Stop Technology

-

Ford's stop-start system, available in vehicles like the Ford F-150, reduces engine idle time, improving fuel economy by up to 10% in urban driving conditions.

BMW EfficientDynamics

-

BMW integrates Auto Start-Stop technology across its vehicle range, particularly in models like the BMW 3 Series, enhancing fuel efficiency without compromising performance.

Toyota Hybrid Systems

-

Toyota’s hybrid vehicles, such as the Toyota Prius, automatically shut down the engine during idling while relying on the electric motor, resulting in significantly reduced fuel consumption and emissions.

Commercial Fleet Adoption

-

Companies like Daimler Trucks, Volvo Trucks, and Navistar are deploying idling prevention systems in their fleets, addressing fuel costs and regulatory compliance.

-

Volvo Trucks reports fuel savings of up to 5% annually through their stop-start systems implemented in commercial vehicles.

Public Transport Initiatives

-

Cities such as London, Tokyo, and Los Angeles have adopted stop-start technology in buses and public transport fleets to meet emission reduction targets.

Challenges Facing the Market

High Initial Costs

-

While the long-term savings are substantial, the upfront cost of installing idling prevention systems remains a concern for budget-conscious buyers.

Wear and Tear on Engine Components

-

Frequent engine starts and stops can cause additional wear on certain components, such as the starter motor and battery.

-

However, advancements in AGM (Absorbent Glass Mat) batteries and reinforced starters are addressing this challenge.

Consumer Awareness

-

Many drivers remain unaware of the benefits of idling prevention systems, creating a barrier to widespread adoption.

Key Market Trends

Integration with Electric Vehicles (EVs) and Hybrids

-

Hybrid and electric vehicles are leading the charge, as they are inherently equipped with stop-start systems to maximize battery efficiency.

Smart Idle Management Systems

-

The adoption of AI-based idle management systems in modern vehicles ensures optimal engine shutdown and restart, further improving efficiency.

Government Incentives and Regulations

-

Subsidies and incentives for vehicles with idle prevention technology are expected to drive market growth, particularly in developed nations.

Micro-Hybrid Systems

-

The rise of micro-hybrid systems, which use stop-start technology alongside regenerative braking, is a key trend in the automotive market.

Regional Analysis

-

Europe: The largest market for idling prevention systems due to strict emission standards like Euro 6 and Euro 7.

-

North America: Driven by anti-idling regulations and increasing fuel prices, the U.S. and Canada are major adopters of this technology.

-

Asia-Pacific: Rapid urbanization and industrialization in countries like China and India are contributing to market growth. China accounts for nearly 25% of the global automotive production.

-

Latin America and MEA: Emerging markets are gradually adopting these systems as awareness and infrastructure improve.

Future Outlook: Where Is the Market Heading?

- The automotive idling prevention systems market is poised for continued growth, driven by:

-

Innovations in battery technology and engine optimization.

-

Increased adoption in electric vehicles and commercial fleets.

-

Growing awareness of environmental sustainability and fuel efficiency.

By 2030, it is estimated that over 80% of new vehicles globally will be equipped with idling prevention systems as standard.

Download Free Business Sample Report>>> "Automotive Idling Prevention Systems Market" Click Here